Is the eVTOL business just burning money, or is it potentially a really good business case few has yet to realize ?

When disruptive services such as AAM (Advanced Air Mobility) and eVTOL (electric Vertical TakeOff & Landing) starts to emerge, skepticism of the disruptions naturally starts to grow: "Is it a Hype or is it a Hope of something better to come in Aviation ?"

Previous Business Cases

The dream, the need and desire of travelling swiftly and effortless directly from A to B is nothing new. Igor Sikorsky briefly visioned it in 1943 and Bell Helicopters in the 60-70's. Scheduled low-cost (subsidized) helicopter routes took place in New York, Los Angeles etc. in the 50-70's, until a tragic accident happened on the roof of Pan Am high-rise building due to poor operational standards.

Later Trump Air tried a similarly setup with scheduled helicopters and as late as 2006-09 US Helicopter tried essentially the same type of setup.

They all had in common it was done with helicopters, and therefore all faced the same essential challenges that they never overcame.

- Not low enough cost to address a wide enough customer potential.

- Unsubsidized not able to earn a profit from what the mass market will pay.

- NOISE: Can not emphasize enough the importance of it, especially in today's world.

- SAFETY: The public must have trust and feel safe having aircrafts flying directly overhead in a crowded airspace on a daily basis in order to accept it. Helicopters that by design has critical components, will probably never be accepted by the public to be used in such a large extent as eVTOL and AAM will accomplish, which the accident on the roof top of Pan Am showed. Safety requirements have to be increased to Airliner level, which EASA has set as the standard in Europe for the upcoming eVTOL's.

Entering eVTOL's

Development of some eVTOL's started over a decade ago, but the public got a peek into a possible future of eVTOL's providing cost-effective, quiet and effortless, fast, clean transportation by air from one location to another, when UBER's White Paper "Elevate" was published in October 2016.

Add digitization to previous attempts, and you have the foundation of BLADE in 2014, utilizing a bespoke UBER-like booking platform incl. crowd sourcing out empty seats that the customer did not want, to lower the cost even further per flight for everyone, i.e. ridesharing. BLADE and UBER even corporated to make a more seemingless experience of travel from address-to-address possible, essentially a MaaS system within their own services put together. Today BLADE is a profitable business.

In corporation with UBER, we tested the concept in Denmark in 2016 at the Roskilde Music Festival, offering customers an UberCHOPPER incl. an UBER car for the last-mile need before & after take-off & landing point.

In corporation with UBER, we tested the concept in Denmark in 2016 at the Roskilde Music Festival, offering customers an UberCHOPPER incl. an UBER car for the last-mile need before & after take-off & landing point.

With ongoing evolution of battery capacity, electric motors getting smaller, lighter and more powerful, eVTOL's development from UAM (Urban Air Mobility) to AAM has evolved into much more than helicopters can ever become, because eVTOL's has addressed the previous issues that got helicopter routes to fail, i.e. high cost, loud noise and not high enough safety level at scale in usage.

Trillions and Trillions of market potential

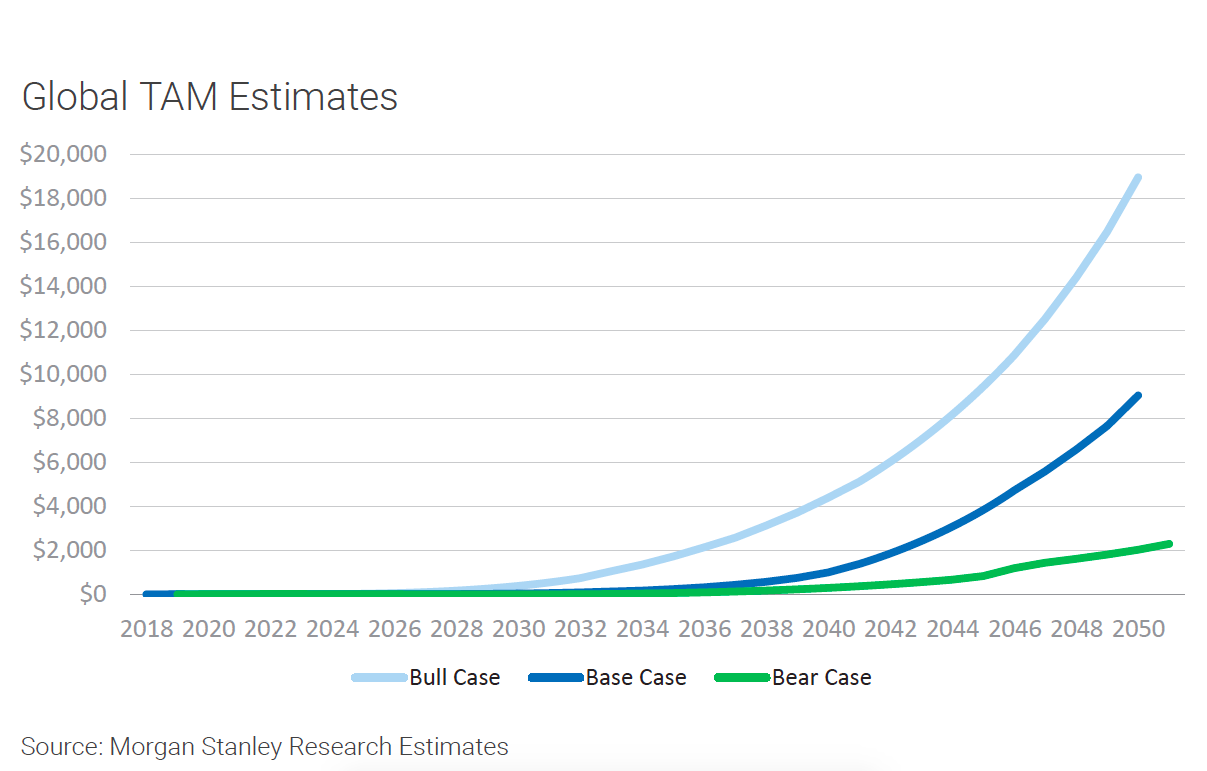

In 2018, revised in 2021 Morgan Stanley published a report forecasting the TAM (Total Addressable Market) of UAM. For example in 2040 TAM as Base Case is valued at $ 1 Trillion.

In 2018, revised in 2021 Morgan Stanley published a report forecasting the TAM (Total Addressable Market) of UAM. For example in 2040 TAM as Base Case is valued at $ 1 Trillion.

As Base Case TAM in 2050 is forecasted to $ 9 Trillion and $ 18,9 Trillion as Bull Case. It can be difficult for many to get their head around such numbers. In comparison to something more tangible that is much in the media and promoted by the government (Energy Islands, Hydrogen production, Power-to-X etc.), TAM for Green Hydrogen in 2050 is forecasted to $ 12 Trillion, so just 33% more than UAM/AAM ... and UAM/AAM gets hardly any attention in the public view.

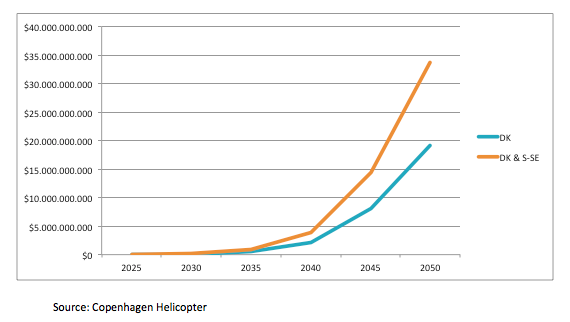

To forecast the Danish and Southern Swedish UAM/AAM market based on Morgan Stanley's report, we have for simplicity intended, scaled the Base Case TAM numbers down to the same proportion as the number of citizens living in Denmark (1,3% of Europe) and Denmark + Southern Sweden (2,3% of Europe). Other factors can later on drive the forecasted numbers up or down locally such as local legislation and policies, society acceptance, geography, weather, other modes of transportation etc., but with our many years of local flight experience, years of cooperation with legislators, thousand of hours of studying many reports and materials etc., we believe this method of simply scaling the TAM numbers down to the size of the local country is roughly representative for now.

To forecast the Danish and Southern Swedish UAM/AAM market based on Morgan Stanley's report, we have for simplicity intended, scaled the Base Case TAM numbers down to the same proportion as the number of citizens living in Denmark (1,3% of Europe) and Denmark + Southern Sweden (2,3% of Europe). Other factors can later on drive the forecasted numbers up or down locally such as local legislation and policies, society acceptance, geography, weather, other modes of transportation etc., but with our many years of local flight experience, years of cooperation with legislators, thousand of hours of studying many reports and materials etc., we believe this method of simply scaling the TAM numbers down to the size of the local country is roughly representative for now.

Billions and Billions of investments

Billions and Billions of investments

These promising forecasts are followed up with significant amount of investments.

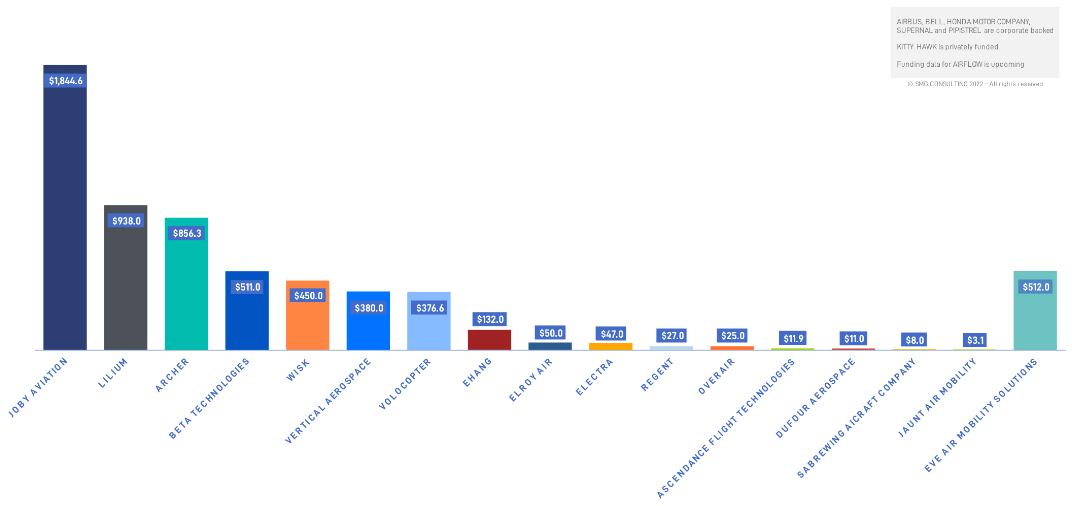

Since 2010 over $ 6 Billion has been invested in different eVTOL developers, where the Top8 has acquired $ 5,8 Billion of the over $ 6 Billion, with the latest $ 450 Million investment from Boeing to Wisk as we reported, and Toyota investing $ 394 Million into Joby Aviation in 2020.

In addition there are the full or partial private- or company funded developers such as Honda, Airbus, Embraer, Hyundai etc., who's individual investment numbers are unknown but estimated in total incl. the previous mentioned to have passed $ 10 Billion in 2021 just for developments and proceeding to get their eVTOL's to market.

Add to the ongoing investments in eVTOL aircrafts, the ongoing investments around the world to build the needed infrastructure, i.e. Vertiports and Vertipads if no existing Heliport exist and the needed investment in drawing up the airspace for optimal and safe usage of the airspace and investment in information campaigns to inform the public what to come.

Add to the ongoing investments in eVTOL aircrafts, the ongoing investments around the world to build the needed infrastructure, i.e. Vertiports and Vertipads if no existing Heliport exist and the needed investment in drawing up the airspace for optimal and safe usage of the airspace and investment in information campaigns to inform the public what to come.

These investment numbers though important and can locally be of some significance, we do not consider these investments as substantial in amount of monetary investment need compared to developing and certify eVTOL aircrafts, since AAM need no physical infrastructure between departure and arrival points like roads, railways, bridges, tunnels etc., just a few square meters of clear and obstacle free land to take-off and land on. A landbased Vertipad- or port can be build for as little as $ 100.000 - 2 millions.

Can the Technology deliver ?

So the economics and commitments looks sound, but can the technology deliver ?

The evidence so far is promising.

- Joby the eVTOL developer most ahead of its competitors which principal design is also used more/less in several other eVTOL developers design, has proved that their 4+1 seater pre-production model though empty of passengers at trials, has exceeded specs by flying +150 miles on one charge, flying faster than 200 mph, produce less than 60dB(A) during hover, be extremely quiet during flightover and climbed to 11.000 feet of altitude. This on current battery technology and it still has two years to fine tune before scheduled certification in 2024.

- Current battery energy density will increase with a factor of nearly 2x around 2025 with the introduction of Solid State Lithium batteries for electric cars (EV's), same technology batteries we will see in eVTOL's as well, giving eVTOL's much longer range or higher payload than for example Joby's current S4 model that achieved +150 miles on one charge. New upcoming batteries with different chemical compositions than Li-Ion can pack even more energy per kg, a topic we will cover in a later article.

So the question was: Are eVTOL's an Economic Bubble ?

All of the above taken into consideration, our answer is; No, eVTOL's are not an Economic Bubble but rather an overlooked business case, that looks to be a very promising one, if executed correctly and on time.

If it should be a bubble, so many experts across the world, so many investors whom many are from very reputable companies will have failed big time especially in their due diligence. That should be considered highly unlikely.